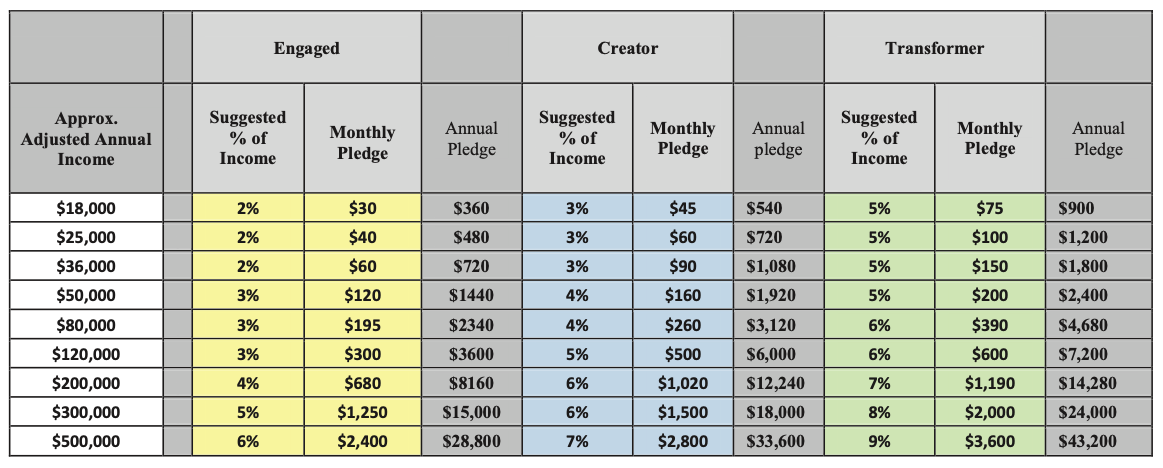

Each of us has unique circumstances to consider in making our calculation. When using The Guide, you may use the amount of your Adjusted Annual Income from your tax return. You can add or subtract to that amount any unusual or periodic income such as inheritance or investment income, and/or any unusual expenses like large medical costs, caring for a parent, or other temporary significant expenses. When you've then determined your adjusted annual income, you can choose from The Guide the commitment level to which you aspire. We hope this helps.

UNITARIAN UNIVERSALIST FELLOWSHIP OF NORTHERN WESTCHESTER

Copyright 2023